The logbook entries describe your knowledge and/or experience in relation to each aspect of the Learning Outcome. Remember where you are using this option there should be at least one logbook sheet for each Learning Outcome you are seeking to address. These logbook sheets will be supported by other documentary evidence referenced in part 2 of the logbook sheet.

The following example shows how this option could be used to evidence competence at Level 1 for one Learning Outcome in the Practice Management Competency Framework.

Learning Outcome: Demonstrate knowledge, understanding and appropriate application of effective procedures for compliance.

| Aspect of the Learning Outcome that needs to be demonstrated | The information that should be included if using this option | Examples of possible supporting documentation |

| Knowledge and understanding of the nomination procedure and suitability for the Money Laundering Reporting Officer (MLRO) | The logbook entry must explain the attributes of a person that would make a suitable MLRO. This could be supplemented by the applicant giving examples of what in their opinion had made some of the MLRO’s they have worked with so suitable for the role. | Doc 1: Logbook entry |

| Doc 2: Supporting note | ||

| Knowledge and understanding of the Money Laundering regulations | The logbook entry must explain your knowledge of the Anti-Money Laundering regulations, ideally giving examples of how they have applied this knowledge. This could be supplemented by the inclusion of your Curriculum Vitae if you have applied this knowledge in any of your roles. Equally good evidence would be the inclusion Anti-Money Laundering Policy that you have drafted, but make sure it links to documents such as your client care letter and your file review procedure. | Doc 3: Logbook entry |

| Doc 4: Supporting note | ||

| Doc 5: Curriculum Vitae | ||

| Doc 6: AML policy |

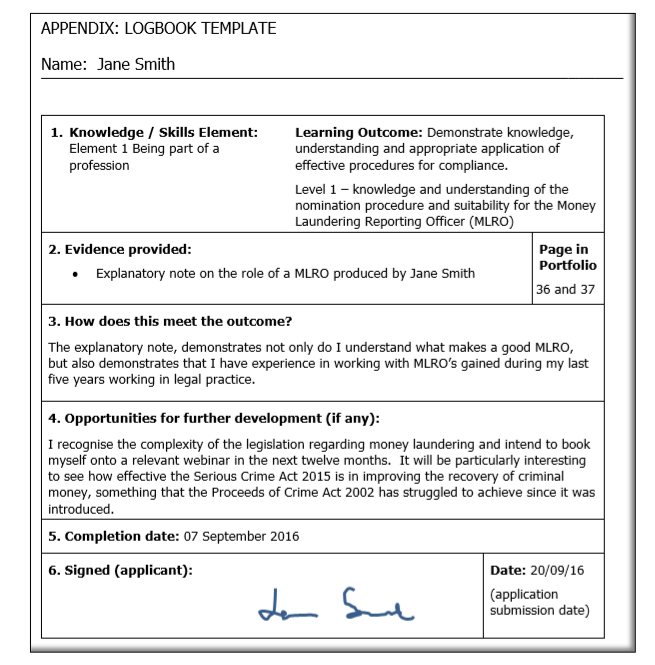

Doc 1: Logbook entry covering:

- Element 1: Being part of a profession

Learning Outcome: Demonstrate knowledge, understanding and appropriate application of effective procedures for compliance

Level 1: Knowledge and understanding of the nomination procedure and suitability for the Money Laundering Reporting Officer (MLRO)

Doc 2: Explanatory note referred to in the logbook entry covering the role of the Money Laundering Reporting Officer (MLRO).

The explanatory note should:

- Explain in detail the role of the MLRO

- Explain the attributes that would make a person suitable to be appointed as an MLRO

- If possible the applicant could provide, examples of MLROs that they have worked with, describing what made them suitable for the role

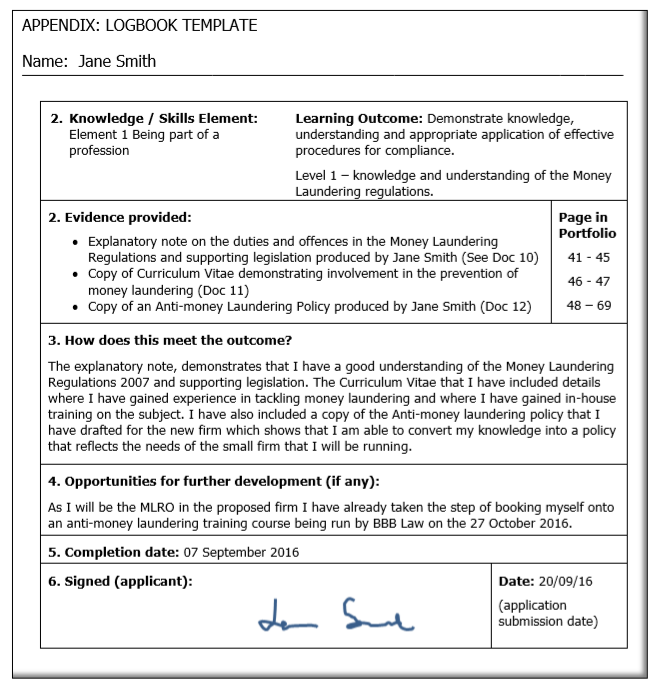

Doc 3: Logbook entry

- Element 1: Being part of a profession

Learning Outcome: Demonstrate knowledge, understanding and appropriate application of effective procedures for compliance

Level 1: Knowledge and understanding of the Money Laundering regulations

Doc 4: Explanatory note on the duties and offences in the Money Laundering Regulations and supporting legislation.

To evidence knowledge and understanding of the Money Laundering Regulations, the explanatory note could include the following:

- The scope of the Money Laundering Regulations 2007, including a description of what constitutes the regulated sector

- Detail the duties placed on the regulated sector by these regulations

- Explain how the regulations link to the Proceeds of Crime Act 2002, detailing the offences and defences

Doc 5: Curriculum Vitae

Here the applicant is using their curriculum vitae to demonstrate that they have experience in anti-money laundering related work. The curriculum vitae will need to:

- Be sufficiently detailed to cover aspects relating to money laundering. It could for example detail how the applicant had helped the MLRO update the firms Anti-money Laundering Policy. Or it could explain the applicant’s responsibilities in relation the Customer Due Diligence checks and file reviews

- Must provide names and addresses of the firms at which this experience was gained along with the dates that they were working at the firm

Doc 6: Anti-money Laundering Policy drafted by the applicant for the firm she is seeking to have authorised.

A good example of an Anti-money Laundering Policy would include the following elements:

- Introduction detailing the purpose of the policy and its scope

- Policy section detailing the firm’s policy in relation to all aspects of anti-money related work

- Anti-money Laundering Guidance section, explaining:

o The offences and defences

o The duties the Money Laundering Regulations place on the firm

– Detail on Customer Due Diligence checks

– Record keeping

– Implementation and review of policies and procedures

– Training

o The Money Laundering Reporting Officer, their role and how they can be contacted

- A section on how to identify potential money laundering

- Copy of the firm’s Customer Due Diligence Procedure

- Copy of the firm’s Procedure for the reporting of suspected or attempted money laundering

- Copy of the firm’s disclosure documentation